America's Trade Policy Hypocrisy

Author: Chris Wood

The so-called Global South is increasingly wary of what it views as the double standards of the developed world.

This issue came to the fore in the global financial crisis of 2008 when Washington and other developed countries indulged in taxpayer financed bailouts whereas in the developing world such economic crises had usually led to IMF prescribed austerity.

This writer was reminded of this issue when in Indonesia recently.

This country continues to be under attack from the World Trade Organization and the IMF because of its government’s policy of banning mineral ore exports.

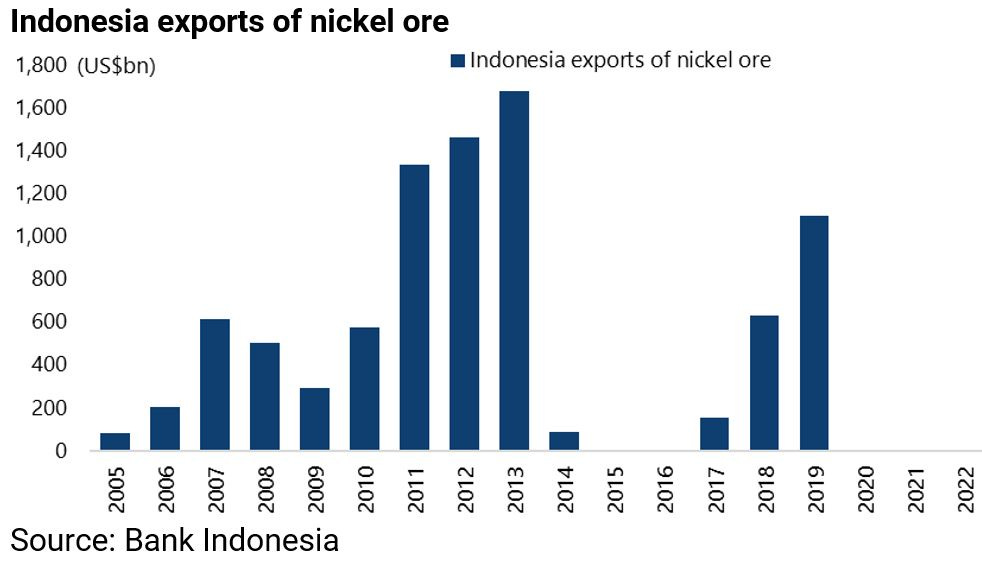

This policy has been implemented in recent years with the most dramatic consequences in nickel where Chinese companies have over the past decade invested more than US$14bn into three major Indonesian processing complexes in Eastern Indonesia.

Indonesia has the largest nickel deposits in the world and, thanks to a process known as high-pressure acid leaching (HPAL), Indonesia’s mainly so-called class-2 nickel can now be refined to where it can be used for battery cathodes in EVs.

Whereas before such nickel was really only used for stainless steel.

The IMF in its latest 2023 Indonesia country report, published in late June, called for Indonesia to consider “phasing out export restrictions and not extending the restrictions to other commodities” (see IMF Country Report: “Indonesia: Staff Report for the 2023 Article IV Consultation”, 25 June 2023).

To quote directly from a related IMF report referenced in the country report, it stated that “the increasing use of trade measures and industrial policies may destabilize the multilateral trade system” (see IMF Policy Paper: “Review of the Role of Trade in the Work of the Fund”, 3 April 2023).

The desire to prevent further restrictions reflects the fact that, while nickel ore exports were banned in January 2020, a ban on bauxite shipments followed in June this year while tin and copper bans are scheduled to come next.

Indonesia’s highly popular president, Jokowi, is a fervent advocate of what he views as a value-added policy. Clearly, the alternative would be continuing to export commodities in a low value-added form.

Meanwhile, the downstream industrialisation has already resulted in major macro dividends.

In 2013 Indonesia exported nickel ores worth US$1.7bn, whereas in 2022 the country exported an estimated US$33bn worth of processed nickel products.

Given this success, it is no surprise that Indonesian government ministers have criticised the efforts by developed nations and the likes of the WTO and the IMF to change the country’s export policies as a form of modern-day colonialism.

The IMF Trade Policy Hypocrisy

Meanwhile, if the Washington-based IMF is criticising Indonesia’s policy for destabilising the multilateral trade system, it has to be wondered what it thinks of the Biden administration’s 2022 Inflation Reduction Act (IRA) with its massive uncapped subsidies to attract investments into America.

So far as this writer is concerned, this is the biggest attack on globalisation and the multilateral trading system seen yet in the ongoing move to promote so-called “onshoring

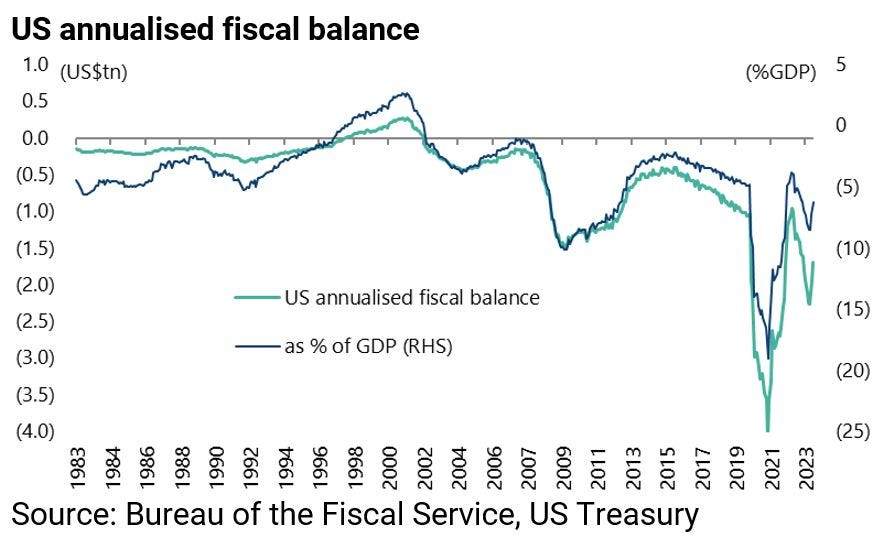

It is also, given the uncapped subsidies, a potentially huge driver of ongoing American fiscal deficits.

For example, the Committee for a Responsible Federal Budget (CRFB) noted in an article in July that the IRA’s energy provisions could cost two-thirds more than originally estimated (see CRFB article: “IRA Energy Provisions Could Cost Two-Thirds More Than Originally Estimated”, 6 July 2023).

At the time of the passage of the IRA the Congressional Budget Office (CBO) and the Joint Committee on Taxation (JCT) estimated that the IRA would spend around US$400bn over the 10 years to 2031 on energy and climate-related provisions, mainly composed of tax credits.

Based on the latest estimates by the JCT, the projected costs have risen to US$660bn through 2031 and to US$790bn through 2033.

Still this writer has heard in a recent meeting an estimate of more than US$1tn for IRA related subsidies.

Meanwhile, the US annualised fiscal deficit has already risen from US$958bn or 3.8% of GDP in July 2022 to US$2.26tn or 8.5% of GDP in July 2023 though it has since fallen to US$1.7tn or 6.3% of GDP in September.

Returning to Indonesia, another criticism of the country’s smelter efforts are the environmental consequences of the HPAL process.

The two main production facilities at Morawali, Central Sulawesi, and Weda Bay, Maluku, will reportedly eventually rely on 5,400 megawatts of coal-fired power (see Asia Times article: “Indonesia’s mineral export bans face hot global fire”, 5 July 2023).

This is a reminder of the environment costs of making electric cars in the so-called “race to zero”.

Returning to the subject of the growing resort to explicit interventionism in industrial policy, in terms of the economic policies of the Biden administration, this writer was also interested to read an article in the Wall Street Journal of late which reported as how the administration plans to implement the other major example of interventionist legislation, namely the CHIPS and Science Act of 2022 (see Wall Street Journal article: “Why Washington Went to Wall Street to Revive the US Chips Industry”, 15 August 2023).

The article discussed how the Commerce Department has built a small team of “elite Wall Street financiers” to help allocate US$39bn in taxpayer-funded manufacturing subsidies.

The job will be to pick winners and losers from some 460 entities which have submitted proposals for subsidies, including the likes of Intel, Samsung and TSMC

.