America's Deteriorating Finances and Why You Shouldn't Own the Dollar

Author: Chris Wood

One topic highlighted in this column of late has been the dramatic deterioration in America’s net international investment position which Stephen Miran, chairman of the Council of Economic Advisers, seemed almost oblivious to when he wrote his by now infamous 41-page paper in November calling on governments to lock in ownership of long-dated Treasury bonds in return for America’s so-called “security umbrella” (see Hudson Bay Capital report: “A User’s Guide to Restructuring the Global Trading System” by Stephen Miran, November 2024).

The base case, along with current consensus, is that the US is not going to proceed with the agenda to the extreme extent outlined in that paper which would amount to an implicit default.

But clearly anything is possible in the Trump administration while any moves in this policy direction are US dollar bearish.

It is also worth noting that Miran has now been appointed to the Fed.

Thus, after Fed governor Adriana Kugler announced her resignation on 1 August, effective 8 August, Trump named Miran to temporary fill the vacated seat until 31 January 2026 when Kugler’s term was set to expire.

US Net Investment Income Negative For the First Time

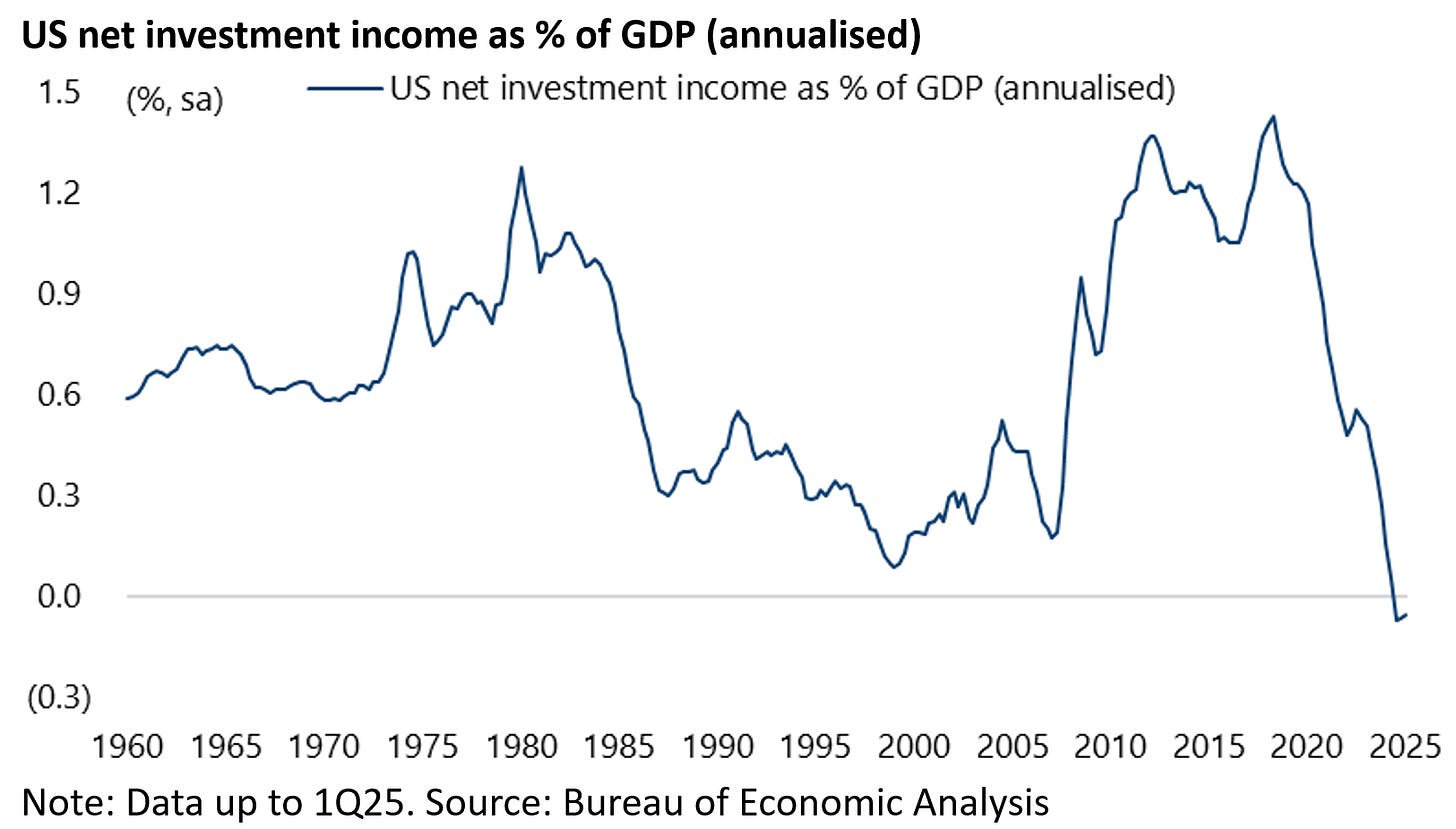

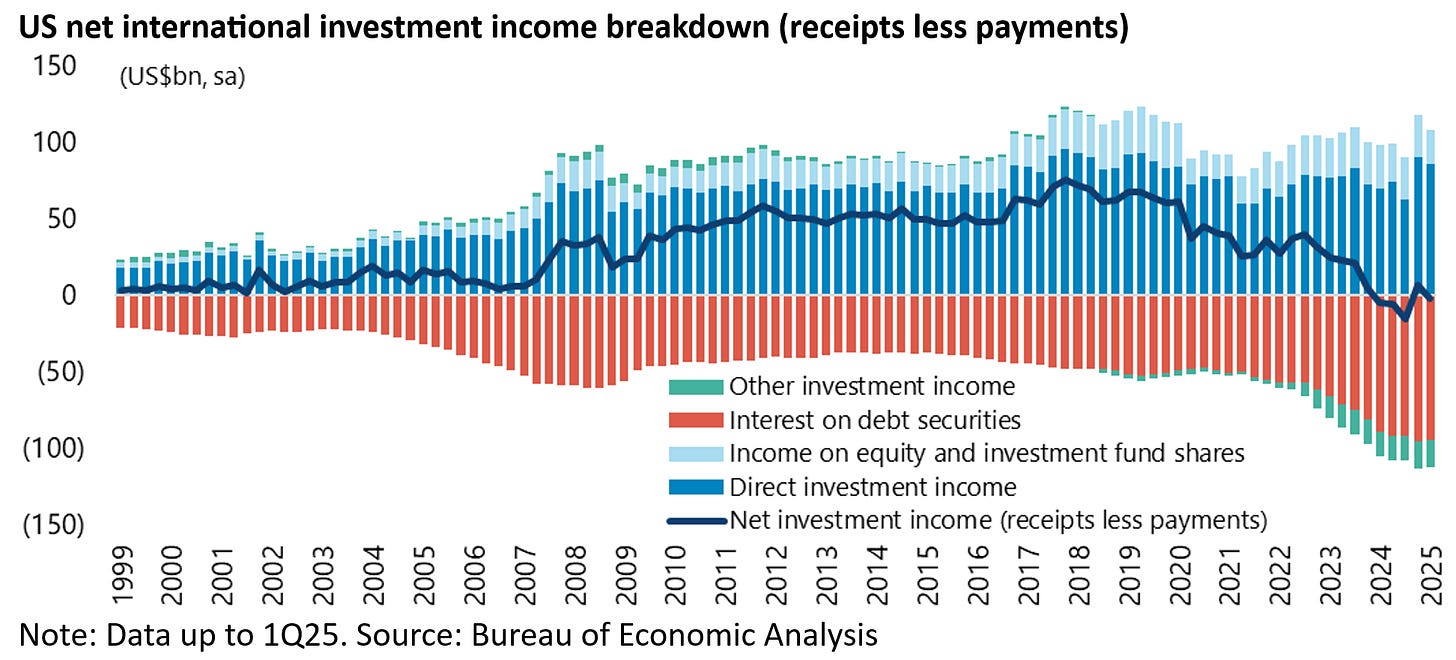

Meanwhile it is important to highlight that recent revised data also shows that America’s net investment income from its net stock of international investment has also finally turned negative.

This is highly relevant since for many years America has managed to produce a positive net investment income flow even though it has run a negative net international investment position (IIP) for 36 years.

Thus, based on the revised data published in June US net investment income has turned negative for the first time since the relevant data series began to be published in 1960.

It fell from an annualised 1.43% of GDP in the four quarters to 2Q18 to a record negative 0.07% of GDP in the four quarters to 3Q24 and was a negative 0.05% of GDP in the four quarters to 1Q25.

To be clear, this is the net income earned from international investments (i.e. income received less payments).

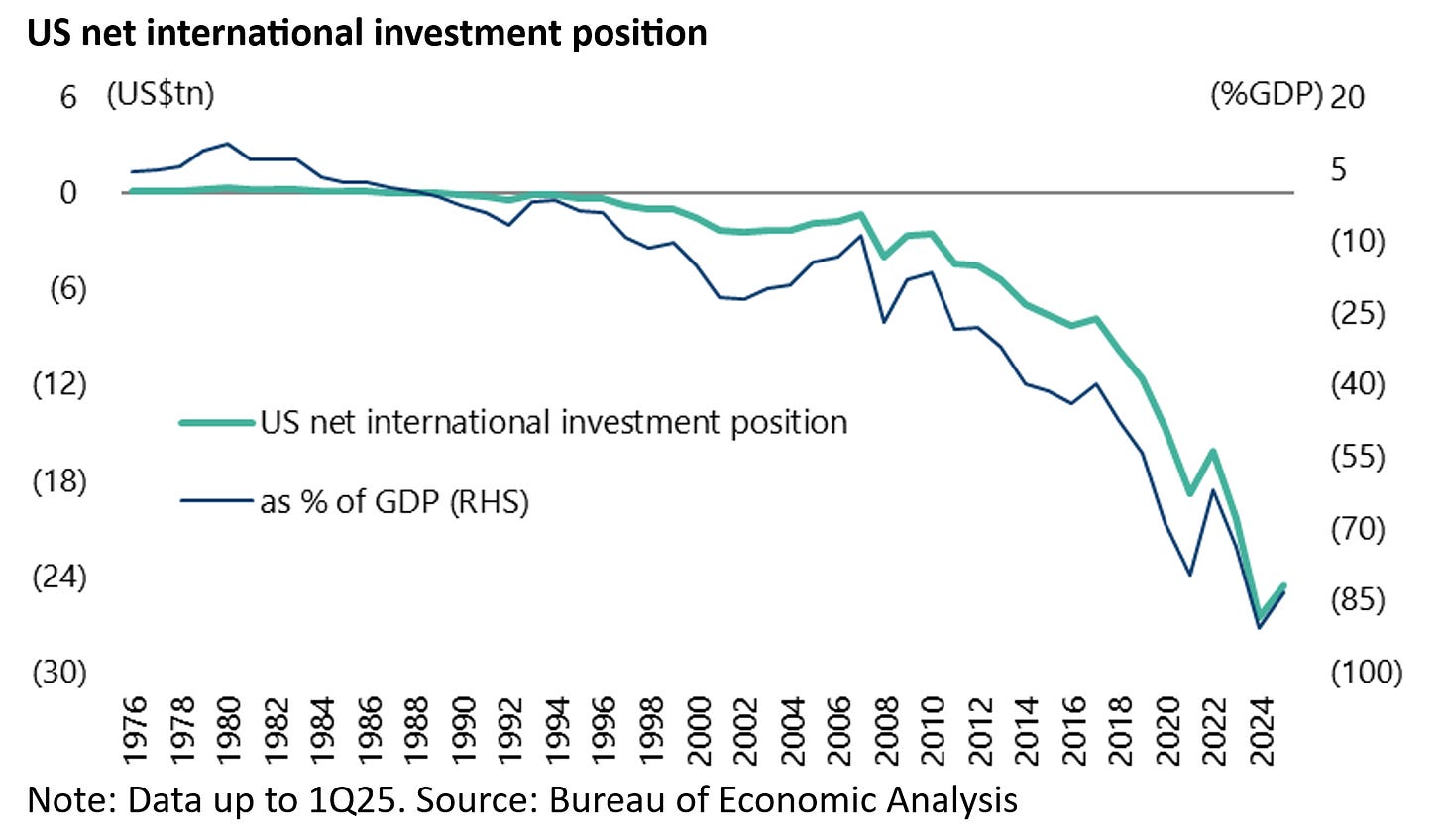

If this is the flow data it is also worth highlighting again the data on a stock basis as previously discussed (see In Tariff Negotiations, Trump Has No Ace Up His Sleeve, 29 May 2025).

Thus, America’s net international investment position deficit has risen from US$7.8tn or 39.9% of GDP at the end of 2017 to a record US$26.5tn or 90.9% of GDP at the end of 2024, having been in deficit since 1989, and was US$24.6tn or 83.4% of GDP at the end of 1Q25.

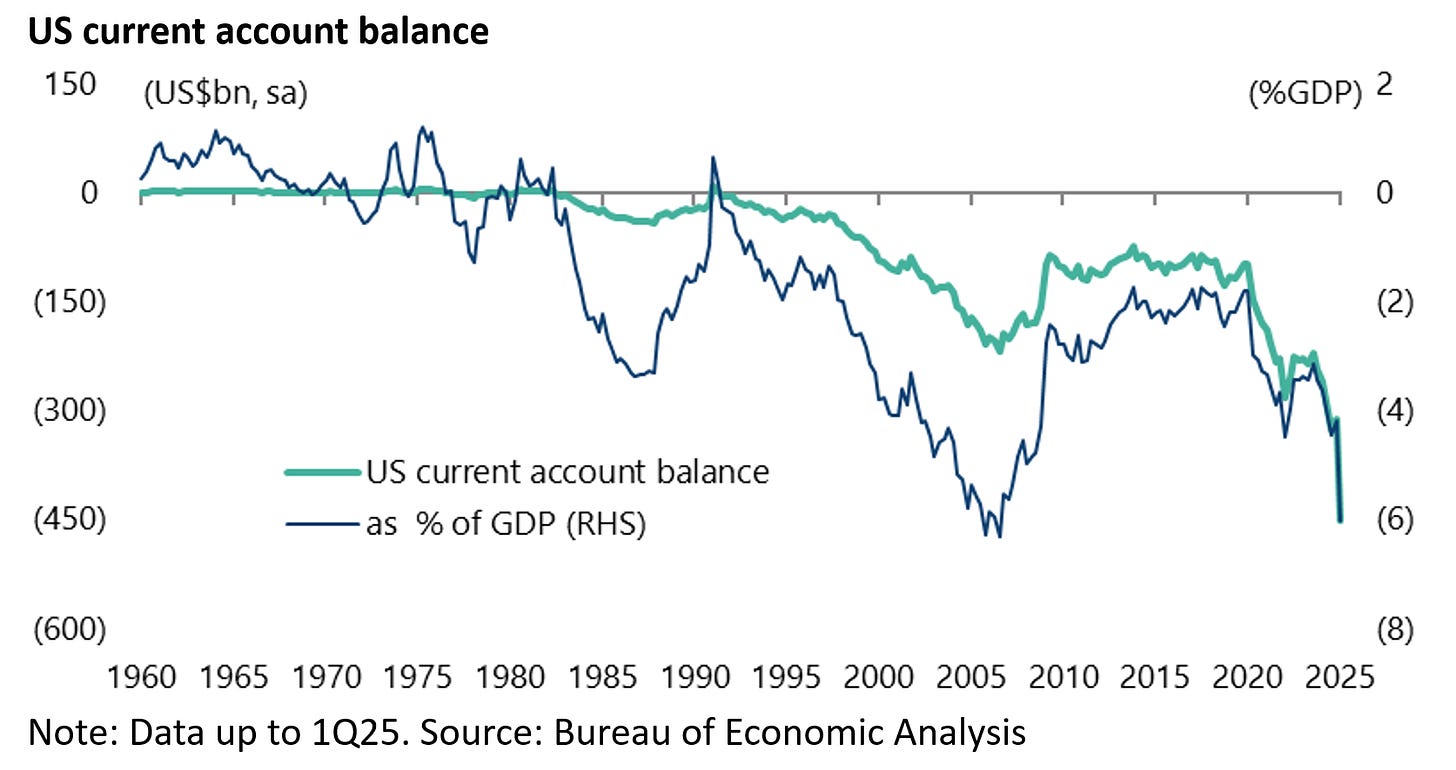

Meanwhile it is further worth highlighting that the US current account deficit increased to 6% of GDP in 1Q25, the highest quarterly deficit since 3Q06 when it reached a record high of 6.3% of GDP.

In US dollar terms the deficit increased by 44% from US$312bn to US$450bn quarter on quarter.

Tariff-related front-end loading of demand was clearly a dynamic at work in the first quarter.

All this keeps this writer long-term bearish on the US dollar even though the US dollar index is up by 1.5% from its 2025 low of 96.4 reached on 1 July.

This is also why this writer continues to advise investors to own Asian currencies from a long-term standpoint.

For the Dollar, Focus on the Big Trend, Not the Short Term Moves

Now it has to be admitted that the US dollar bearish call has been consensus in recent months.

That is why it is extremely telling that the dollar seems incapable of sustaining any kind of sustained rally at all, though clearly countertrend rallies will always happen.

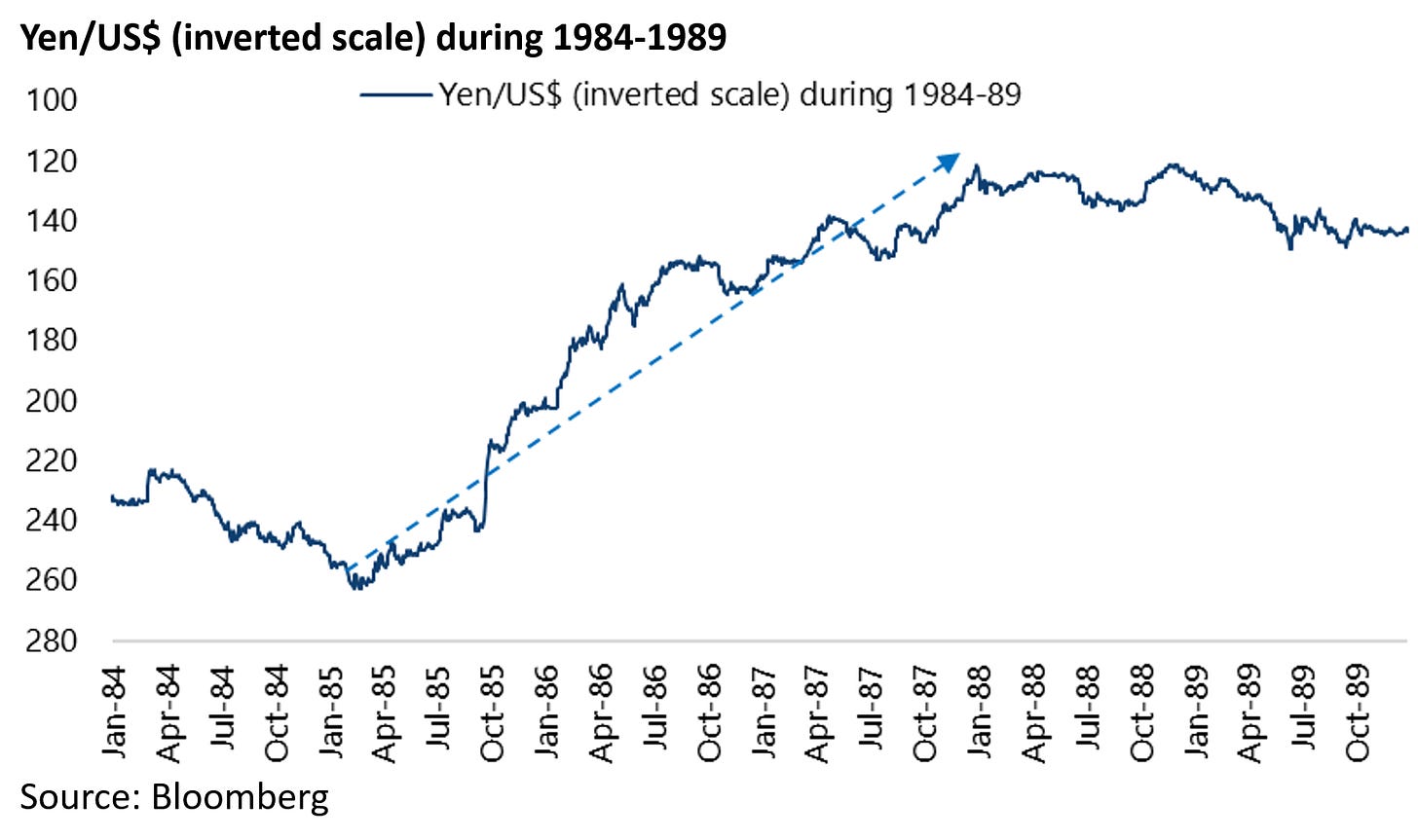

On this point sometimes it does not make sense to focus on short-term consensus readings, in terms of trader positioning and the like, if a really big trend is under way.

An example is the 117% appreciation of the yen against the US dollar in a 34-month period between February 1985 and December 1987 following the Plaza Accord of 1985 when the yen rose from Y263/US$ to Y121/US$.

That was a big and quick move but even then there were two countertrend rallies of 7.6% and 9.5% respectively during that period.

Low borrowing Costs Were the Secret to America's Strong Financial Position - Are Those Days Over?

Meanwhile it is worth noting why US net investment income stayed positive for so long despite the long prevailing negative on the stock of investment.

A closer look at the data suggests that net income earned from overseas direct investments managed to remain higher than net interest payments on debt securities to foreign creditors in the period between 1Q09 and 3Q23.

Net direct investment income averaged US$74.6bn per quarter in the period between 1Q09 and 3Q23, compared with average net interest payments on debt securities of US$46.7bn per quarter over the same period.

By contrast, net direct investment income has averaged US$75.9bn per quarter since 4Q23, while average quarterly net interest payments on debt securities have risen to US$90.4bn over the same period reflecting higher bond yields.