AI Stock Buyers Beware

Author: Chris Wood

It is the strangest of worlds. AI capex mania in the US gets ever more extreme in an American stock market driven primarily by retail investors and passive investment strategies while at the same time the gold price, and in particularly long ignored gold mining stocks, have of late gone vertical.

Yet the long end of the Treasury bond market remains remarkably calm, all things considered, even as the US dollar remains essentially weak.

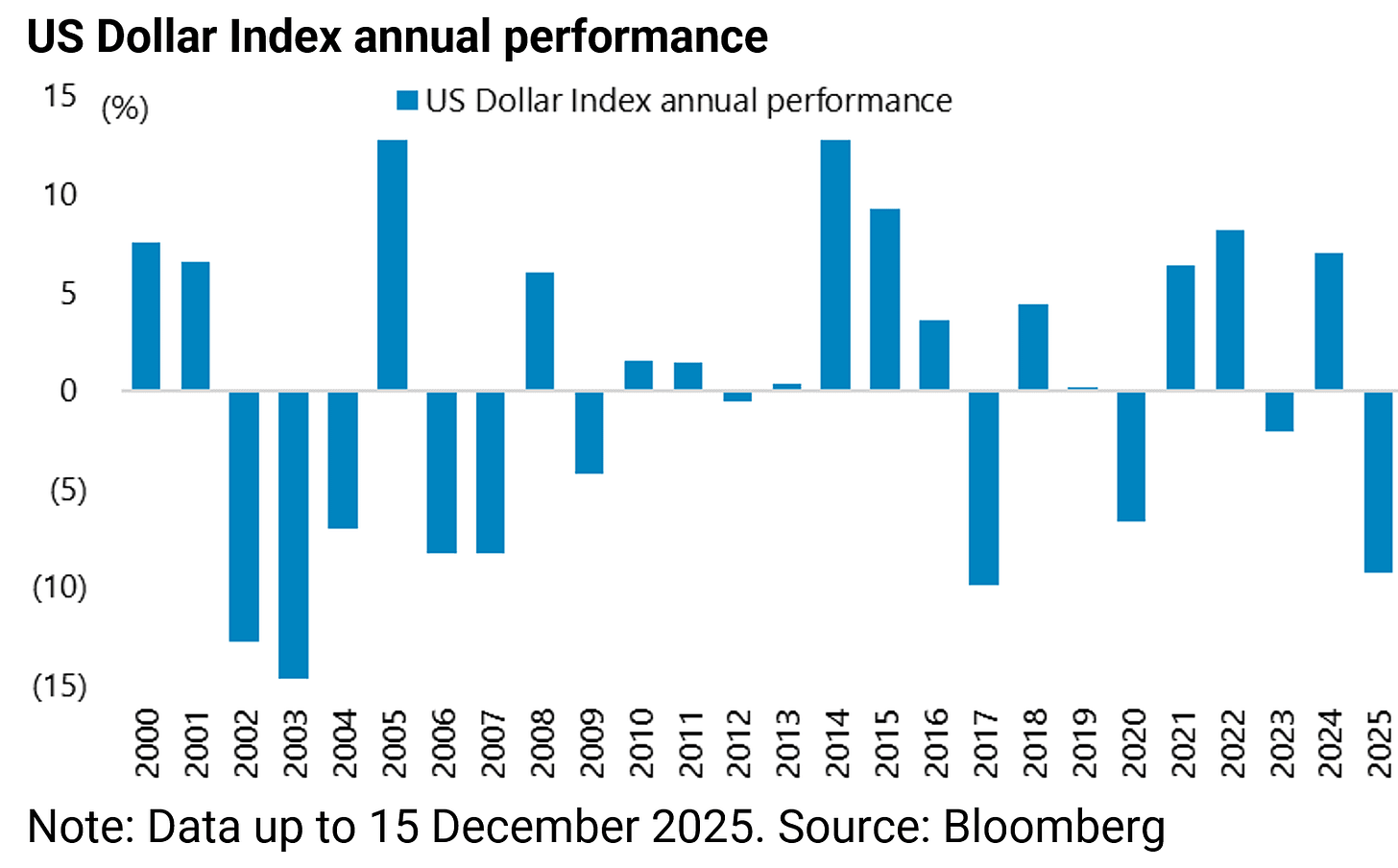

The US dollar index is now down 9.3% year to date, its worst performance in any year since 2017.

Meanwhile the recommencement of Federal Reserve easing has, for entirely understandable reasons, given the bulls more confidence.

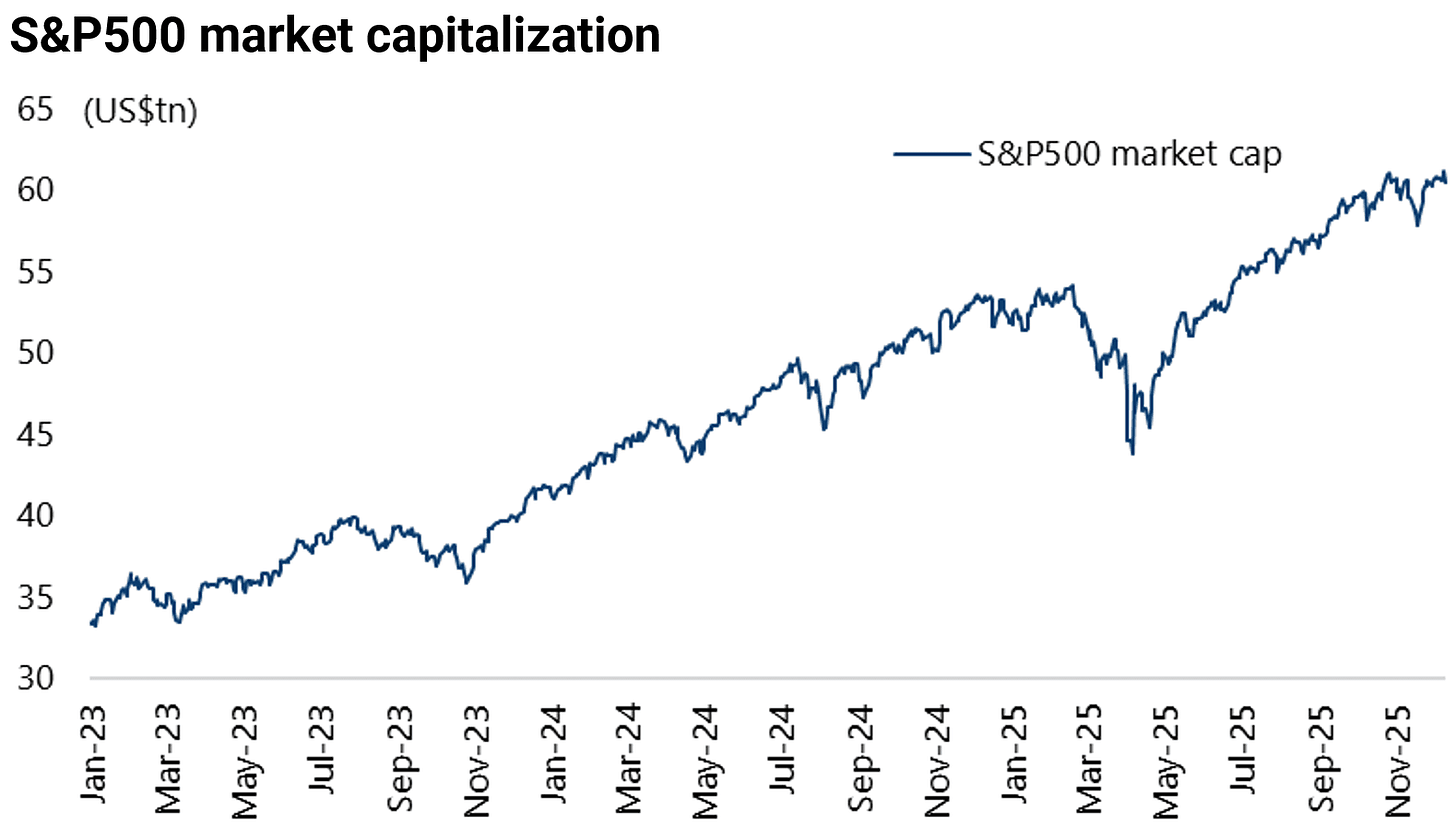

The increase in the S&P500 market cap since bottoming in early April is US$16.6tn, which is equivalent to 54% of America’s GDP.

US Economic Health is Now Highly Geared to the Stock Market

That has provided massive support to the American economy in terms of the wealth effect and raises an entirely legitimate question mark over the Fed’s decision to resume easing.

Yet the American economy is extremely lopsided with an estimated 49.2% of consumption accounted for by consumers in the top 10% of the income distribution, according to an interesting recent analysis by Moody’s Analytics’ chief economist Mark Zandi (see Bloomberg article: “Top 10% of Earners Drive a Growing Share of US Consumer Spending”, 17 September 2025).

What is abundantly self-evident is that the American economy is now extremely geared to the US stock market, with the outcome of the AI capex cycle the key determinant of the latter’s long-term health.

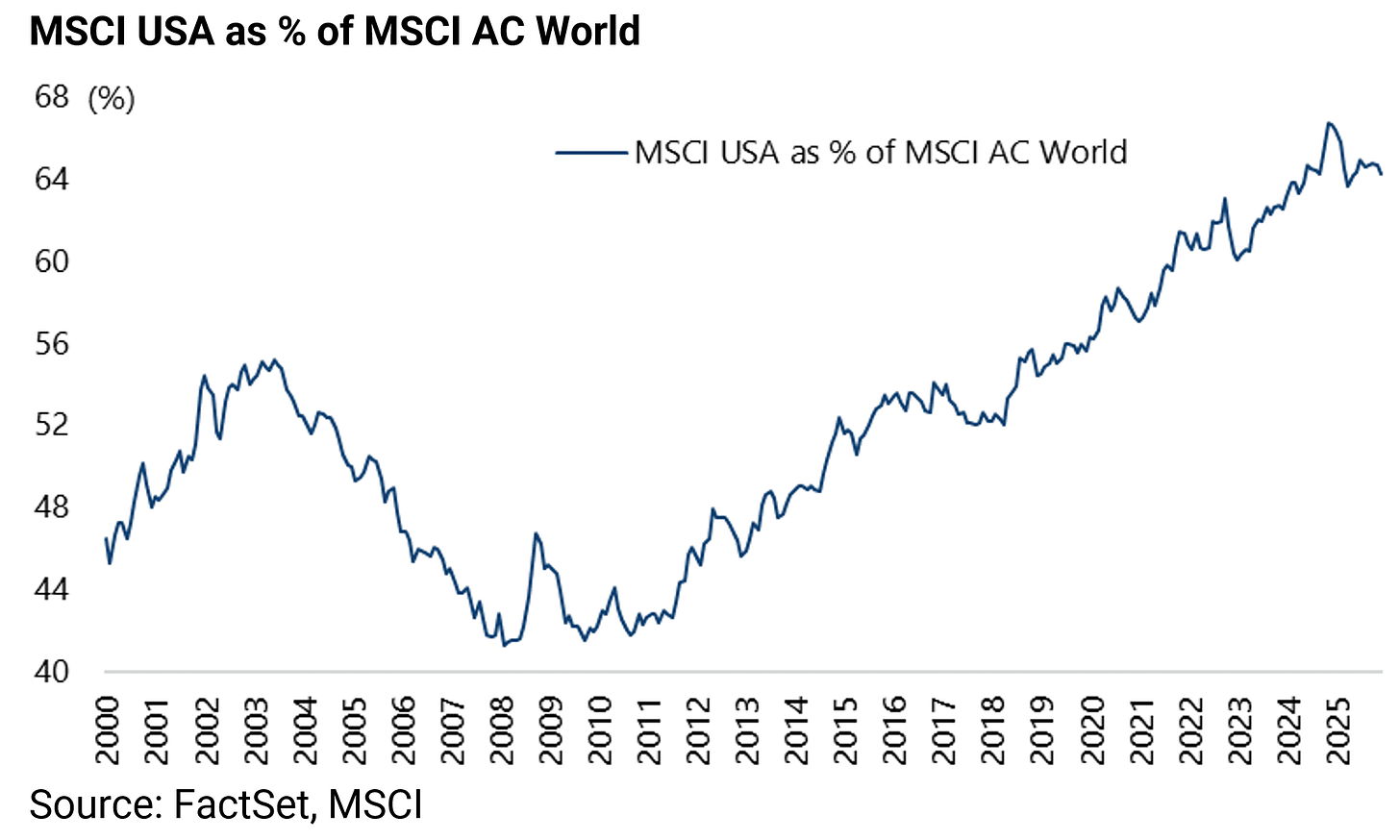

This writer’s base case remains that the US stock market peaked as a percentage of MSCI All Country World late last year at 67.2% on 24 December 2024.

But this view will likely be wrong structurally if the AI capex is successfully monetised which is not the base case here.

Still this writer could also be wrong tactically if this momentum continues for longer, helped by the likes of continuing Fed easing and the beneficial impact of OBBBA in terms of delaying the accounting impact of the capex spend for Big Tech, via extended depreciation schedules and the like, as the hyperscalers’ business models turn from asset light to asset heavy.

For now the US market is at 64.2% of MSCI All Country World, which is still below the peak recorded late last year as other major stock markets have been rallying, most interestingly China where the AI theme has also increasingly been the thematic driving share prices but from a much lower valuation level than in the US.

This writer vastly prefers from an investment standpoint the Chinese approach to AI which appears to be much more practical, as discussed here previously (see Key Takeaways From Our Recent Trip to Beijing, 6 August 2025).

But for now the lessons from the DeepSeek moment in late January have been completely forgotten by investors in the US market.

Still they remain highly relevant.

Signs are Emerging of a Speculative Mania in Stocks

Meanwhile, markets are ever more reflexive in the AI era as retail investors appear to have been buying the stocks their AI chatbots have been telling them to in the ultimate feedback loop. Indeed, there have been mounting symptoms of speculative mania in the US.

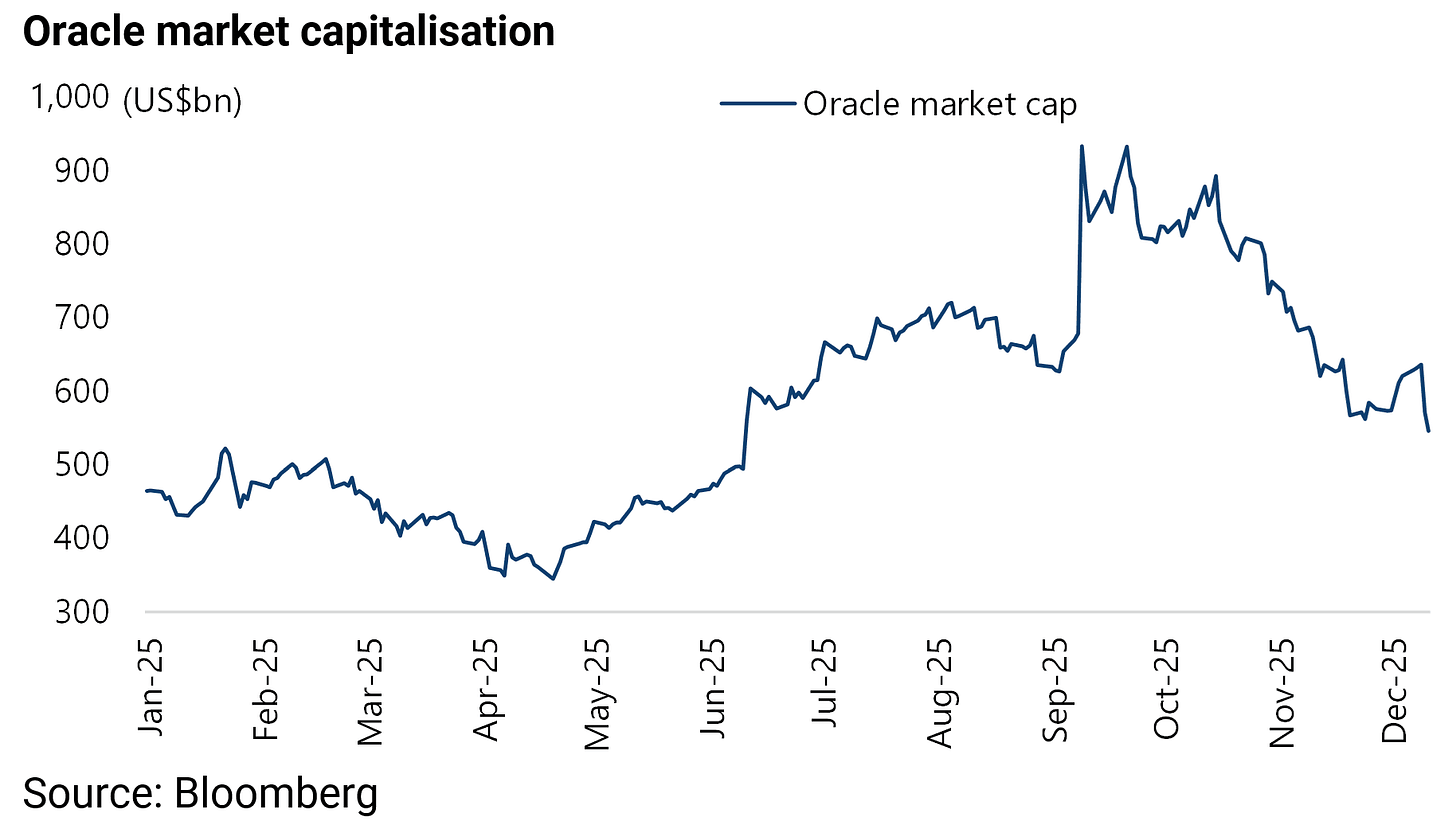

One of the most dramatic was the euphoric market reaction to Oracle’s earnings report in early September.

The company shares rose nearly 40% in a day, or by US$255bn, after Oracle said it had increased its outstanding contracted revenues not yet realised by 359% YoY to US$455bn in 1QFY26 ended 31 August.

One day later Oracle confirmed where a large part of this increase came from when it announced it had signed a US$300bn deal to provide OpenAI with computing power over a five-year period.

The interesting point is that OpenAI is reportedly currently losing about US$1bn a month and generating around US$13bn in annual revenues.

The company has also told investors it will burn US$115bn in cash by 2029.

In the context of these numbers, the scale of the OpenAI-Oracle contract looks ambitious in the extreme. In fact, OpenAI’s focus on investing huge sums scaling up proprietary large language models remains the exact opposite of the cheap open source approach adopted by DeepSeek, which in this writer’s view is much more likely to generate commercially viable use cases applying AI technology.

Meanwhile, Oracle’s share price has now declined by 42% since the September announcement.

If the Oracle news was already remarkable, a few weeks before Nvidia had announced it will invest as much as US$100bn in OpenAI to support the building out of new data centres and related AI infrastructure.

That should in theory increase Oracle’s chances of getting paid.

The news followed a number of other investments made by Nvidia in AI-related companies, most of whom like OpenAI are also its customers in what looks suspiciously like a return to the vendor financing model which blew up in the Nasdaq bust at the start of this century.

One example of a company Nvidia partners with is CoreWeave whose business, so far as this writer understands it, is primarily about buying Nvida GPUs to rent them out.

Yet the returns from renting out GPUs are said to be falling.

This renting out business and the related financing, which can be viewed as a sort of digital equivalent to the WeWork, is an area for investors to keep an eye on. For if there is going to be an unravelling it is likely to show up there first.

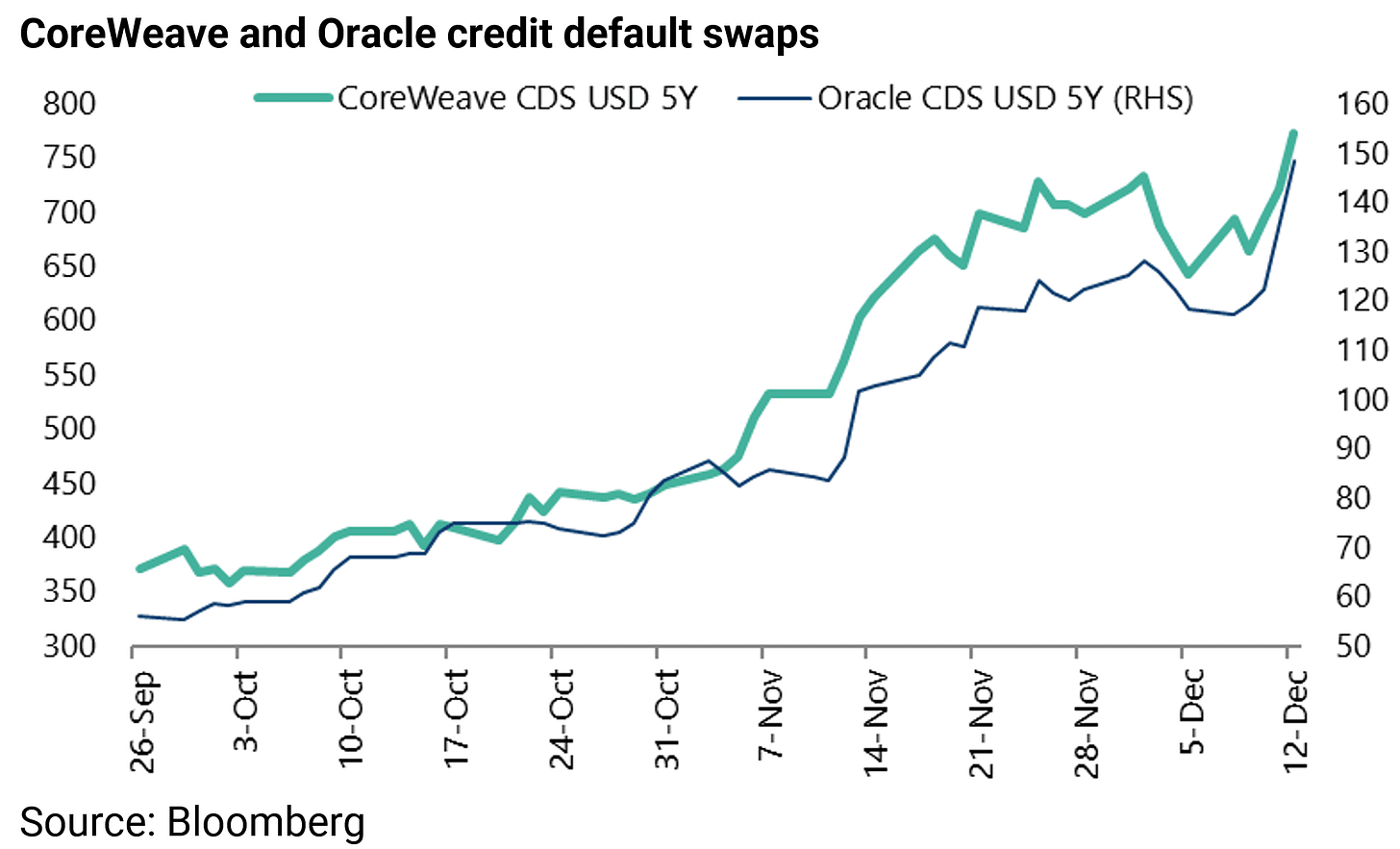

Markets have begun to react to all of the above as can be seen in the rise in credit default swaps (CDS) of both Oracle and CoreWeave, both of whom are leveraged unlike the hyperscalers.

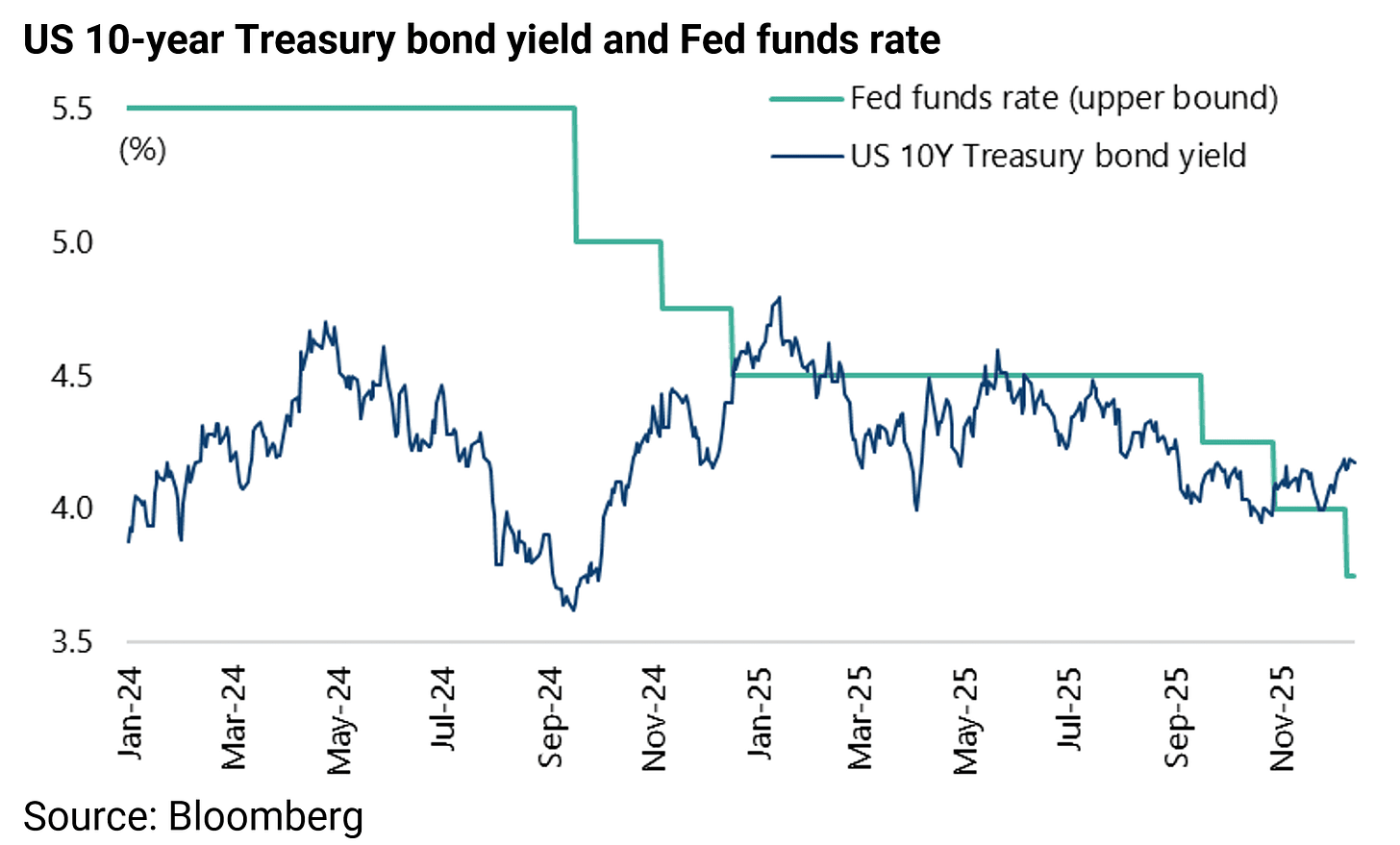

Meanwhile, the Federal Reserve cut the Fed funds rate by another 25bp last week and also resumed balance sheet expansion.

The Fed cut rates by 25bp on 10 December to 3.5-3.75% as widely expected. But, more interestingly, the Fed decided to resume balance sheet expansion again by initiating purchases of shorter-term Treasury securities (mainly Treasury bills) “for the sole purpose of maintaining an ample supply of reserves over time”.

It plans to purchase US$40bn of Treasury bills in the first month starting last Friday.

Still perhaps the most interesting development as regards the Fed of late was the public reference by new Fed governor, Stephen Miran, in his testimony to the Senate in September to a “third mandate”, namely “moderate long-term interest rates” (see Bloomberg article: “Fed ‘Third Mandate’ Forces Bond Traders to Rethink Age-Old Rules”, 16 September 2025).

Apparently, this is referenced in the original statement in the Federal Reserve Reform Act in 1977.

Still what Mr. Miran, who is also chairman of the Council of Economic Advisers, may have meant by this, so far as this writer is concerned, is targeting the long end of the yield curve.

This is of course the same Mr Miran who wrote the by now notorious paper recommending foreign creditors of the US should agree to invest in century Treasury bonds at a below market yield in return for America’s “security umbrella”, as discussed here in the past (see Mar-A-Lago Accord Deep Dive: Implications and Risks, 29 April 2025 and Hudson Bay Capital report: “A User’s Guide to Restructuring the Global Trading System” by Stephen Miran, November 2024).

The arrival of Miran at the Fed and the talk of “third mandates” is a reminder, if it were needed, of the likely end game of some form of yield curve control which would clearly be US dollar bearish and gold bullish.

Equity Investors Should Start Preparing Their Portfolios for Rising Bond Yields

Meanwhile the ten-year Treasury bond yield has so far remained remarkably calm in the face of renewed Fed easing.

Last year it rose by 116bp in four months after the Fed resumed easing in mid-September 2024 from 3.65% to a recent high of 4.81% on 14 January.

This year the 10-year Treasury bond yield has so far risen by only 15bp from 4.03% to 4.18% since the Fed resumed easing in mid-September.

For this reason, in this writer’s view it is now a good idea for equity investors to hedge their portfolios by betting on a pickup in bond volatility.

Remind Me Why you Still Own G7 Government Bonds?

Meanwhile this writer maintains the view, held here since March 2020, that investors should look to dispose of all G7 “risk free” government bonds.

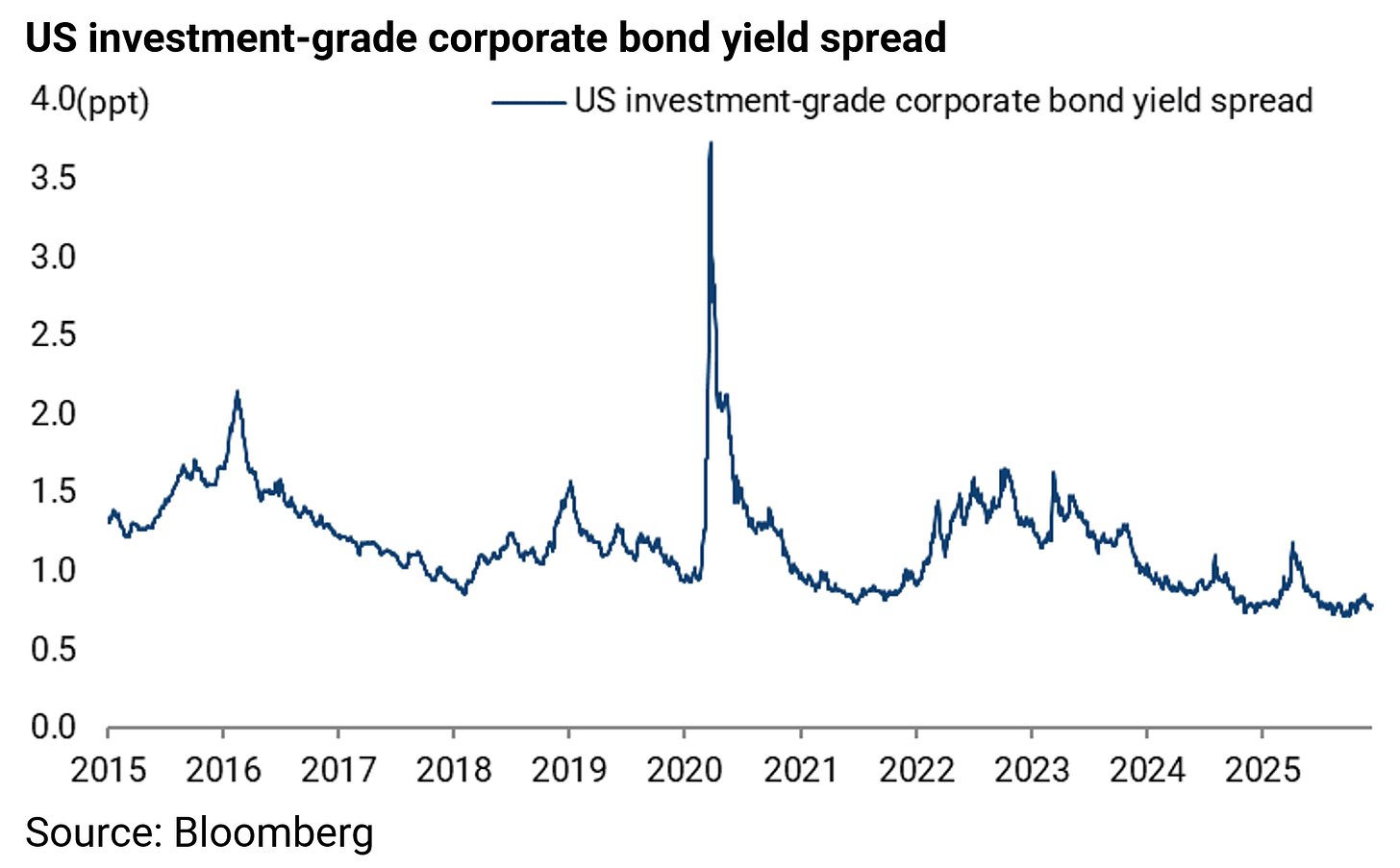

In this respect, the current record low spreads on investment-grade corporate bonds should be seen in the context that the likely end game in the G7 world is that the best corporate bonds trade through government bonds, in terms of yields, because of their vastly superior balance sheets.

The US investment-grade corporate bond yield spread has declined from 119bp in April to 72bp in mid-September, the lowest level since mid-1998, and is now 78bp.

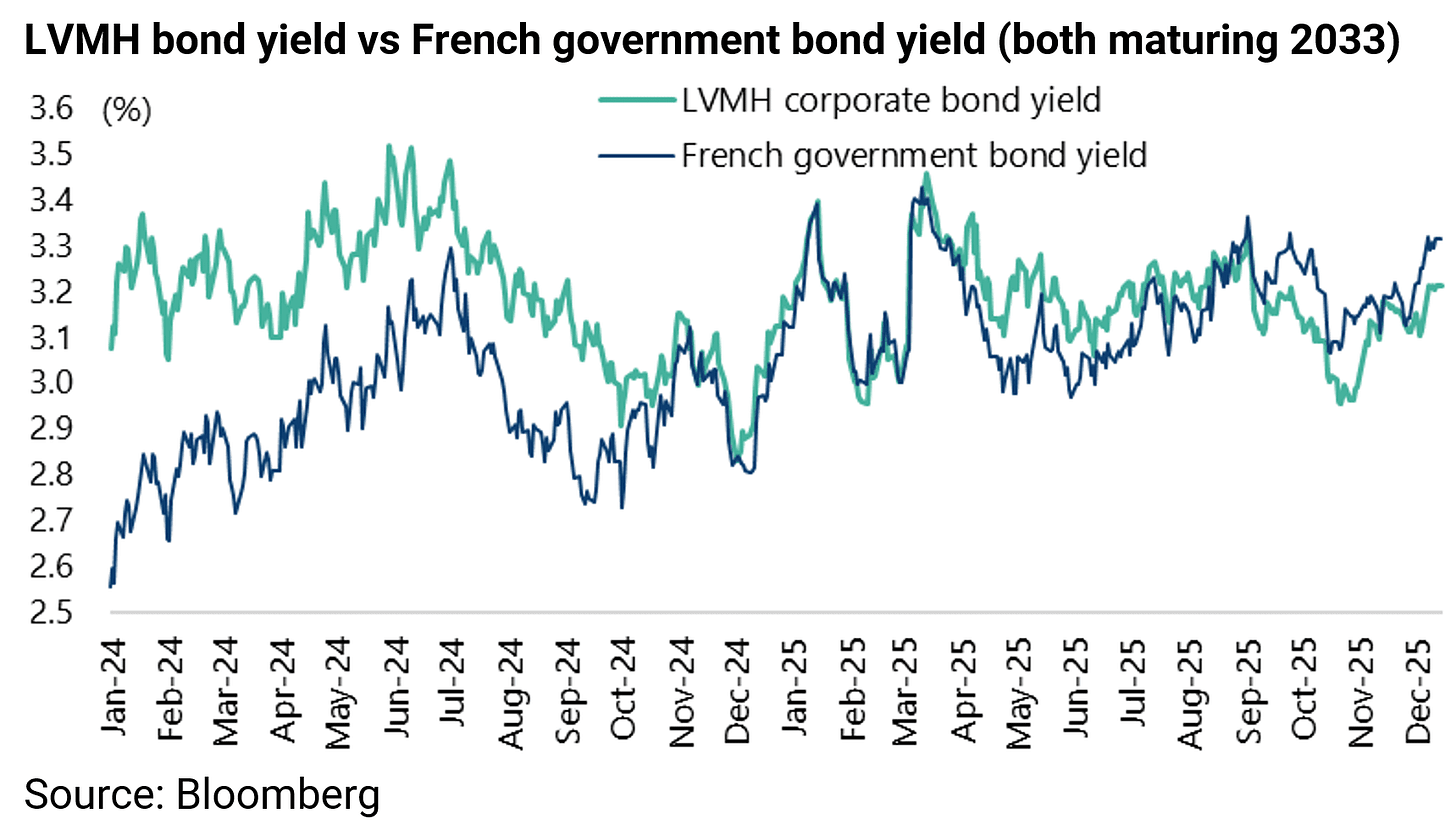

Indeed such a trade through government bond yields has already happened in France of late, with borrowing costs for some French companies falling below French government bond yields of a similar maturity (see Financial Times article: “French companies’ borrowing costs fall below government’s as debt fears intensify”, 14 September 2025).

For example, the LVMH bond maturing 2033 with a 3.5% coupon now yields 3.21% or 10bp below the yield of the French government bond maturing 2033.